If you’ve read this blog for any period of time, you know that I hold very pessimistic views of the economy. I worried about the housing bubble long before it burst–though I admit I knew nothing about the financial instruments that Wall Street was creating that enabled the bubble and made its bursting a bigger economic event.

Lately, I’ve been concerned that the cycle where the US issues government bonds to essentially enable our lifestyle that allows us to buy lots of imports from places like China, and China buys those bonds to ensure that there continues to be a market for their goods. That cycle can’t go on forever.

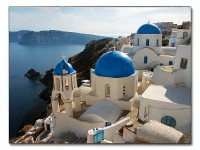

Today, I was listening to a recent Planet Money podcast about Greece’s current debt problems. One of the people interviewed on the podcast made the following statement which seems to say the same thing I’ve worried about (emphasis added):

Most of the developed world is screwed . . and that makes this crisis particularly different than anything we’ve seen in our lifetimes. . . The countries that aren’t screwed are the emerging market countries. They have very low levels of debt, both public and private sector. So, they’re not impacted to the same extent. It’s been a complete flip-flop. The developing world is now where the rich world was 30 years ago. . . The world has been turned on its head, so now the emerging market is lending money to the rich world, so the rich world has continued to spend more than they’ve made for decades.

What we’re talking about here is an adjustment that’s going to happen not just in Greece, around the rest of Europe. It’s going to have to happen in the UK, it’s going to have to happen in the US as well. People at some point are going to have to develop a better connection with what government spending means for them personally. We’ve had the better part of a couple of decades where people have lost that connection. It’s viewed as manna from heaven and it’s just an entitlement, something that everyone has deserved that has no impace, or should have no impact, ever on them. They should be able to borrow unlimited amounts, get unlimited amounts of government services and benefits with no repercussions. It’s not all free money. The money has to be paid back.

A New York Times article discusses

A New York Times article discusses